Memorial Service Cost Planning Strategies

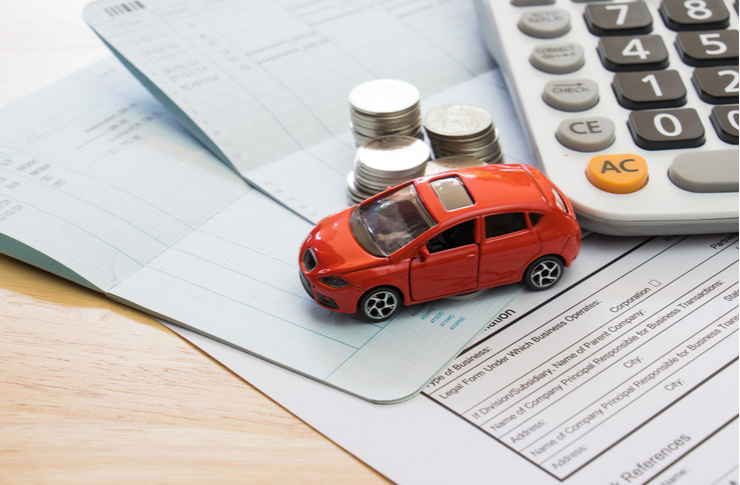

Planning for end-of-life expenses is a thoughtful way to ease the financial burden on loved ones during an already difficult time. Memorial services and related costs can add up quickly, often catching families unprepared. Understanding the various options available for managing these expenses—from prepaid arrangements to specialized coverage—helps individuals make informed decisions that align with their financial situation and personal wishes. This guide explores practical strategies for planning memorial service costs and protecting your family from unexpected financial strain.

Memorial services represent a significant financial consideration that many people postpone addressing until circumstances force the conversation. The average cost of a funeral in the United States ranges from $7,000 to $12,000, depending on location, service type, and personal preferences. These expenses can include professional services, transportation, caskets or urns, burial plots, headstones, and ceremonial arrangements. Without advance planning, families may face difficult financial decisions during emotionally challenging moments.

What Are Funeral Insurance Plans?

Funeral insurance plans are specialized policies designed to cover end-of-life expenses. These plans typically offer coverage amounts between $5,000 and $25,000, specifically intended to pay for funeral services, burial or cremation costs, and related expenses. Unlike traditional life insurance, funeral insurance plans usually require no medical examination and accept applicants across a wide age range. Premiums remain fixed throughout the policy term, and benefits are paid directly to beneficiaries or funeral homes. These plans provide peace of mind by ensuring that memorial service costs will not become a financial burden for surviving family members.

Understanding Final Expense Coverage Options

Final expense coverage options encompass various financial products designed to address end-of-life costs. Whole life insurance policies with smaller face values serve as one option, providing permanent coverage with cash value accumulation. Guaranteed issue life insurance accepts all applicants regardless of health status, though it may include graded benefit periods. Modified expense policies offer immediate coverage for accidental death while imposing waiting periods for natural causes. Each option presents different premium structures, benefit amounts, and qualification requirements. Evaluating your health status, age, budget, and coverage needs helps determine which final expense coverage option best suits your circumstances.

How Burial Insurance for Seniors Works

Burial insurance for seniors specifically addresses the needs of older adults seeking affordable coverage for funeral expenses. These policies typically accept applicants between ages 50 and 85, with simplified underwriting processes that ask basic health questions rather than requiring medical examinations. Coverage amounts generally range from $2,000 to $25,000, with premiums based on age, gender, coverage amount, and sometimes health factors. Many policies build cash value over time and offer level premiums that never increase. Seniors appreciate burial insurance because it provides guaranteed acceptance options, immediate coverage in many cases, and the certainty that funeral costs will be covered regardless of when death occurs.

Exploring Prepaid Funeral Plans

Prepaid funeral plans allow individuals to arrange and pay for their funeral services in advance, locking in current prices and specifying personal preferences. These arrangements involve working directly with funeral homes to select specific services, merchandise, and ceremonial details. Payment options include lump-sum payments or installment plans spread over several years. Prepaid plans protect against inflation by guaranteeing that selected services will be provided regardless of future price increases. Funds are typically held in trust accounts or backed by insurance policies. While prepaid plans offer price protection and detailed planning control, they may lack portability if you relocate and can be difficult to modify once established.

Effective Funeral Cost Planning Approaches

Funeral cost planning involves assessing your financial situation, researching available options, and making informed decisions about how to fund end-of-life expenses. Start by obtaining price lists from local funeral homes to understand typical costs in your area. Compare different funding mechanisms, including dedicated savings accounts, insurance products, and prepaid arrangements. Consider your family’s financial capacity and whether they could manage unexpected expenses. Factor in personal preferences regarding burial versus cremation, service complexity, and location. Review and update your plans periodically to ensure they remain aligned with your wishes and financial circumstances. Communicating your plans with family members prevents confusion and ensures your preferences will be honored.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Funeral Insurance Policy | Globe Life | $5,000-$15,000 coverage, $30-$100 monthly premiums |

| Guaranteed Issue Life Insurance | Mutual of Omaha | $2,000-$25,000 coverage, $40-$150 monthly premiums |

| Prepaid Funeral Plan | Local Funeral Homes | $5,000-$12,000 one-time or installment payments |

| Final Expense Whole Life | Gerber Life | $5,000-$50,000 coverage, $35-$200 monthly premiums |

| Burial Insurance | Colonial Penn | $5,000-$20,000 coverage, $35-$120 monthly premiums |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Comparing Insurance and Prepaid Options

When deciding between insurance products and prepaid funeral plans, consider flexibility, portability, and control. Insurance policies provide cash benefits to beneficiaries who can use funds for any purpose, offering maximum flexibility if circumstances change. Prepaid plans lock in specific services at current prices but may limit options if you move or change preferences. Insurance policies remain portable regardless of location changes, while prepaid plans may involve transfer fees or complications. Insurance products allow beneficiaries to shop for services after death, potentially finding better values, whereas prepaid plans commit to specific providers. Evaluate your likelihood of relocating, desire for planning control, and preference for flexibility versus price certainty when choosing between these approaches.

Planning for memorial service costs represents an act of consideration for those you will leave behind. Whether you choose funeral insurance plans, prepaid arrangements, or other financial strategies, taking action now prevents your loved ones from facing difficult financial decisions during grief. Research your options thoroughly, compare costs and benefits, and select the approach that best fits your financial situation and personal values. Review your plans periodically and communicate your wishes clearly to ensure your memorial service reflects your preferences without creating financial hardship for your family.